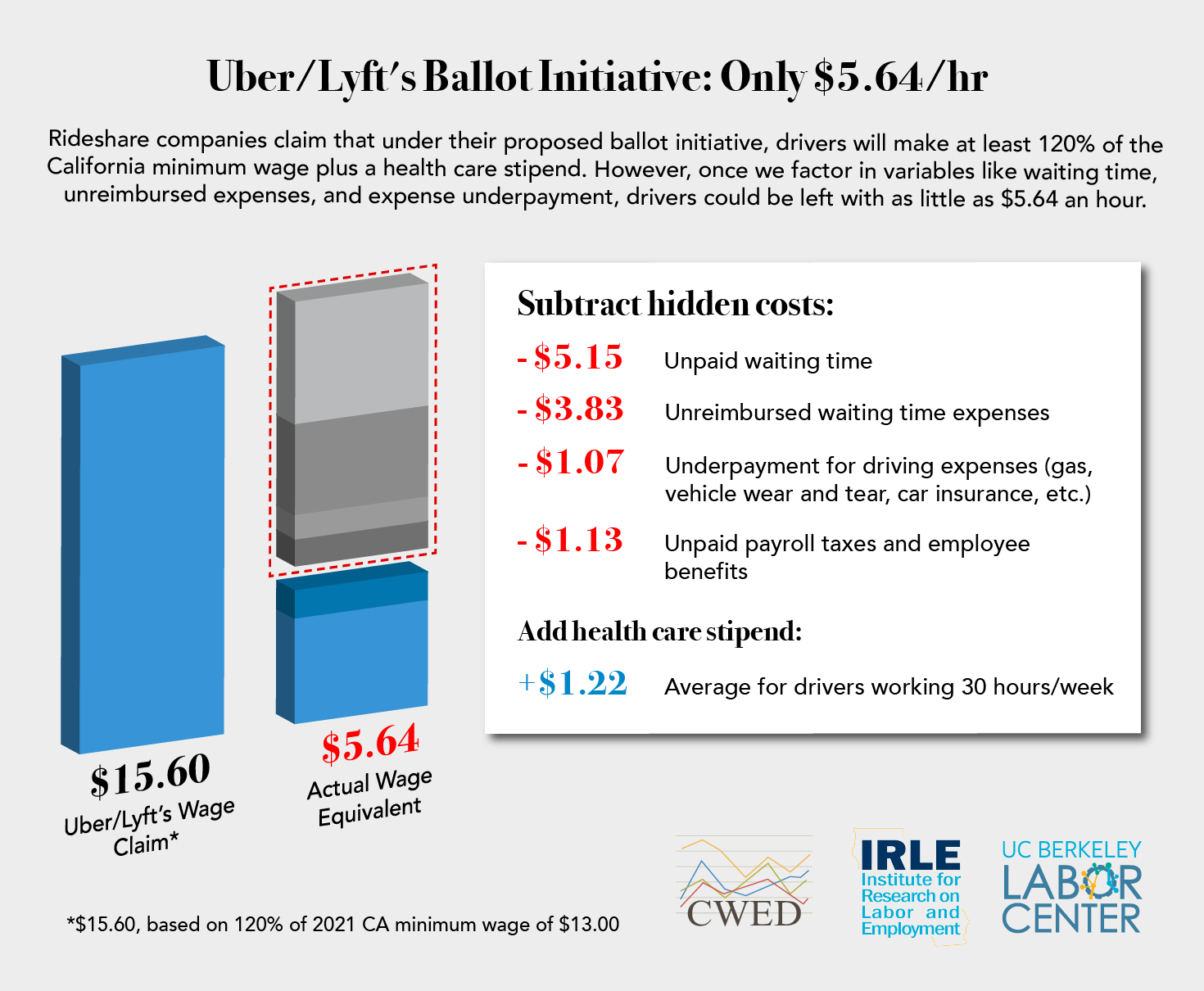

The Uber/Lyft Ballot Initiative Guarantees only $5.64 an Hour

FROM THE UC BERKELEY LABOR CENTER, JOINTLY PRODUCED WITH THE UC BERKELEY CENTER ON WAGE AND EMPLOYMENT DYNAMICS

Uber, Lyft, and DoorDash have unveiled their ballot initiative to undo historic worker protections enshrined in AB5, California’s new law that tightens the criteria for worker classification. The initiative claims drivers will receive a guaranteed pay equal to 120% of the minimum wage (that would be $15.60 in 2021, when the California minimum wage will be $13). Our review of the initiative leads to a very different estimate. After considering multiple loopholes in the initiative, we estimate that the pay guarantee for Uber and Lyft drivers is actually the equivalent of a wage of $5.64 per hour. Harry Truman was president the last time the inflation-adjusted value of the minimum wage was that low. Indeed, the real level of the pay guarantee is about one third of the required minimum pay for drivers under New York City’s new driver pay standard.

Here are the loopholes that change the guarantee from $15.60 to $5.64 (see also the accompanying graphic):

1. Driver waiting time is not counted as work time

The initiative’s guarantee only applies when the drivers are engaged with passengers—when they are en route to picking up a passenger and when they have a passenger in their vehicle; these engaged times amount to only 67 percent of the drivers’ working time. The companies would not pay for the approximately 33 percent of the time that drivers are waiting between passengers or returning from trips to outlying areas. But such time is a necessary part of drivers’ work. Whether a driver wants to work one hour, eight hours, or any amount in between, they must wait between dropping off passengers and getting their next ride. Not paying for that time would be the equivalent of a fast food restaurant or retail store saying they will only pay the cashier when a customer is at the counter. We have labor and employment laws precisely to protect workers from that kind of exploitation.

Taking into account that the drivers would be paid only for 67 percent of all the time they are working, actual earnings per working hour would be 67 percent of $15.60, or $10.45.

2. Unreimbursed costs of driving while waiting for a ride

Much of the drivers’ waiting time is spent driving and cruising. Drivers may be heading back from a drop off to an area where they are more likely to have a pick up, or they may be circling in downtown areas where there is no place to park. Under the companies’ proposal, none of the costs (gas, wear and tear on the vehicle, etc.) of driving while waiting would be covered as reimbursed employee expenses. Uber drivers average 20 miles an hour. Therefore, they drive 6.6 miles each hour (33 percent of 20) that would not be reimbursed.

Multiplying the Internal Revenue Service mileage reimbursement rate of 58 cents a mile by 6.6 miles, we obtain $3.83 of unreimbursed expenses per hour of driving while waiting for a ride. $10.45 minus $3.83 leaves $6.62.

3. Under-reimbursed costs during drivers’ engaged driving time

The ballot initiative says the drivers’ cost of driving, during the time they are engaged with passengers, will be reimbursed at 30 cents per mile. But the IRS estimates that the real per mile costs of owning and operating a vehicle are 58 cents per mile. The initiative’s lower figure assumes the drivers already have a vehicle and are driving just a few hours a week; it does not include all the fixed costs of acquiring, owning and operating a vehicle. Yet a small share of drivers, who work long hours, account for the vast majority of all drivers’ miles—10 percent of transportation platform drivers account for about 57 percent of driver earnings. These drivers need to cover the fixed costs of owning and operating a vehicle.

According to the ballot initiative, Uber and Lyft would purchase insurance for drivers during the time they are engaged to pick up a passenger or have a passenger in their vehicle. Since insurance costs about 20 cents a mile, and again using the IRS 58 cents per mile standard, the initiative’s offer of 50 cents per mile for costs and insurance still leaves drivers eight cents per mile short in covering their driving expenses when they are engaged with passengers.

We multiply the eight cents per mile deficit by the average 13.4 miles of engaged driving miles each hour. The result is $1.07 in under-reimbursed driving costs per working hour. Subtracting $1.07 from $6.62, we obtain $5.55.

4. Health care stipend

The companies would also offer a health care stipend to drivers who average at least 15 engaged hours a week in a quarter and who are enrolled in a qualifying health plan. Drivers averaging at least 15 but less than 25 engaged hours in a quarter would receive a stipend equivalent to 41 percent of the average premium for a Covered California Bronze plan; those working more than 25 engaged hours would receive a stipend equal to 82 percent of the same plan. The vast majority of drivers would not qualify for this benefit. To be consistent with our treatment of expenses, we include the value of the benefit for a 30 hour a week driver. We estimate the stipend for a 30 hour a week driver would average about $1.22 an hour (details available from the authors). Adding $1.22 to $5.55, we obtain an hourly pay level of $6.77.

5. Unpaid payroll taxes and employee benefits

Since the drivers would be classified as independent contractors, they would be required to pay both the employer and employees share of payroll taxes. And they would not receive paid rest breaks, paid meal breaks, paid sick leave, unemployment insurance, and other benefits required to be provided employees under state and federal law. The costs of these taxes and the value of those benefits together add up to about $1.13 per hour. Subtracting $1.13 from $6.77, we arrive at an hourly pay value of only $5.64 an hour.

This estimate may be too high, as it does not take into the account the cost of worker compensation insurance. Under the ballot initiative, companies would provide some occupational accident insurance, but at levels well below the protections required by California’s laws for employees.

Closing the door to higher standards

The initiative would not only roll back the standards in AB5. It would also preclude local governments from enacting their own higher labor standards, such as those already proposed in Los Angeles and El Monte. Localities would not be permitted to set standards to govern compensation, scheduling, leave, healthcare, and termination of an app-based driver’s contract. Similar policies are already in effect in New York City and under consideration in Seattle.

In addition, the initiative would require a 7/8 vote of the state legislature for future amendments. This is an unusually high requirement. Any desirable future changes in the law to respond to new technologies, or to comply with other California laws or policies, would need to be enacted by another ballot initiative.

Caveats

Our analysis applies only to the two transportation network companies (TNCs) — Uber and Lyft. We have not looked into what it would mean for delivery network companies like DoorDash, though many of the same considerations would apply. We have used the best available data to analyze the effects on the pay of TNC drivers. However, the companies have refused to make their own data public. For a complete analysis, the state needs much more data from the companies, including detailed data on wait times, hours worked, and earnings. The companies should provide that data in California, as they currently do in New York City, to allow for independent analysis so that voters are able to make informed choices. Finally, it is important to note that nothing in AB5 requires companies to reduce drivers’ flexibility over the hours they work.

Conclusions

New York’s pay standards, which went into effect in February of this year, show that drivers’ earnings can be increased while preserving driver flexibility and maintaining service levels for customers. The companies have a choice over how they adjust to comply with California’s laws protecting workers—or if they choose to fight those laws with a ballot initiative that would take pay standards back seventy years.

Ken Jacobs is the Chair of the UC Berkeley Labor Center. Michael Reich is Professor of Economics, University of California, Berkeley and co-chair, Center on Wage and Employment Dynamics. He is a co-author of the report that led to a driver pay standard in New York City.

The Labor Center and the Center for Wage and Employment Dynamics (CWED) are both projects of the Institute for Research on Labor and Employment (IRLE) at UC Berkeley. IRLE connects world-class research with policy to improve workers’ lives, communities, and society.