Research Bio

Dmitry Taubinsky applies insights from behavioral economics to questions about public policy, using a combination of theory, surveys, experiments, quasi-experiments, observational data. He studies topics such as people's (in)attention to not-fully-salient taxes; (mis)understanding of tax incentives such as those present in the income tax code; energy policy for consumers inattentive to the energy costs of durables; optimal "sin taxes" on sugary drinks; the welfare effects of social recognition; financial decision-making by low income populations such as payday loan borrowers; and policies aimed at improving savings decisions.

Research Expertise and Interest

behavioral economics, tax policy, soda taxes, payday loans, household consumption and portfolio choice, energy policy, health, gambling, state-run lotteries, inflation expectations, nudges

In the News

Nudges Aren’t Always Good for Society

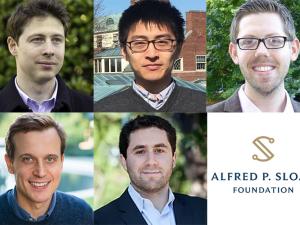

Five young scholars named Sloan Research Fellows

Featured in the Media

Dmitry Taubinsky of the University of California, Berkeley, is one of three authors publishing on the "optimal" tax rate that for sugar taxes.